Are FAFSA delays turning college dreams into nightmares?

This year, delays with the Free Application for Federal Student Aid (FAFSA) are causing a lot of worry for students and families. The new FAFSA system, which has a simpler application and a new way of calculating aid, has pushed back the release of financial aid information until the middle of March - much later than the usual January timeline. In this article, we look at how these delays are affecting students' and families' emotions, finances, and academic plans.

Key takeaways

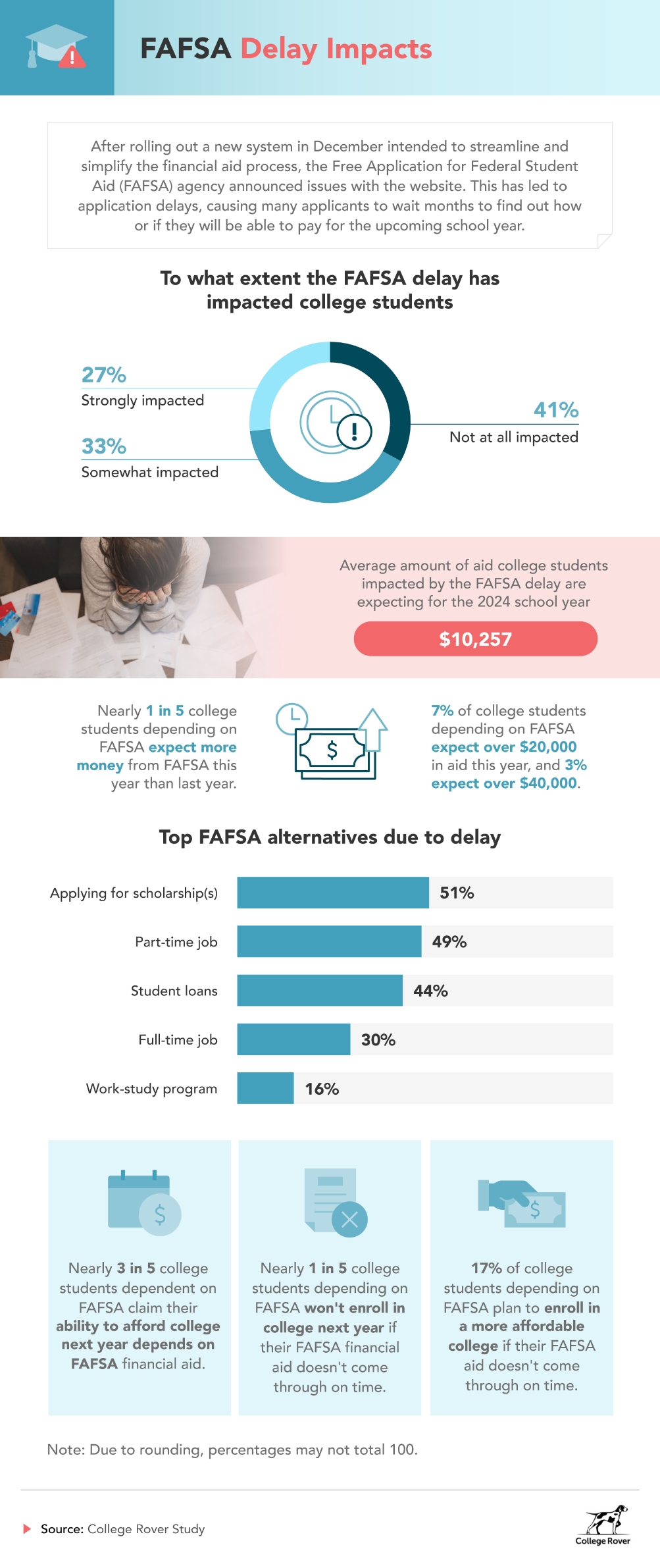

- 3 in 5 college students (60%) are at least somewhat impacted by the FAFSA delay.

- Nearly 60% say their ability to enroll and afford college next year depends on getting financial aid on time.

- Nearly 1 in 5 who depend on FAFSA (18%) for financial aid awards won't enroll in college next year if their aid doesn't come through on time.

- Nearly 1 in 5 expect more money from their FAFSA this year than last year; 7% expect over $20,000 in aid for the 2024 school year.

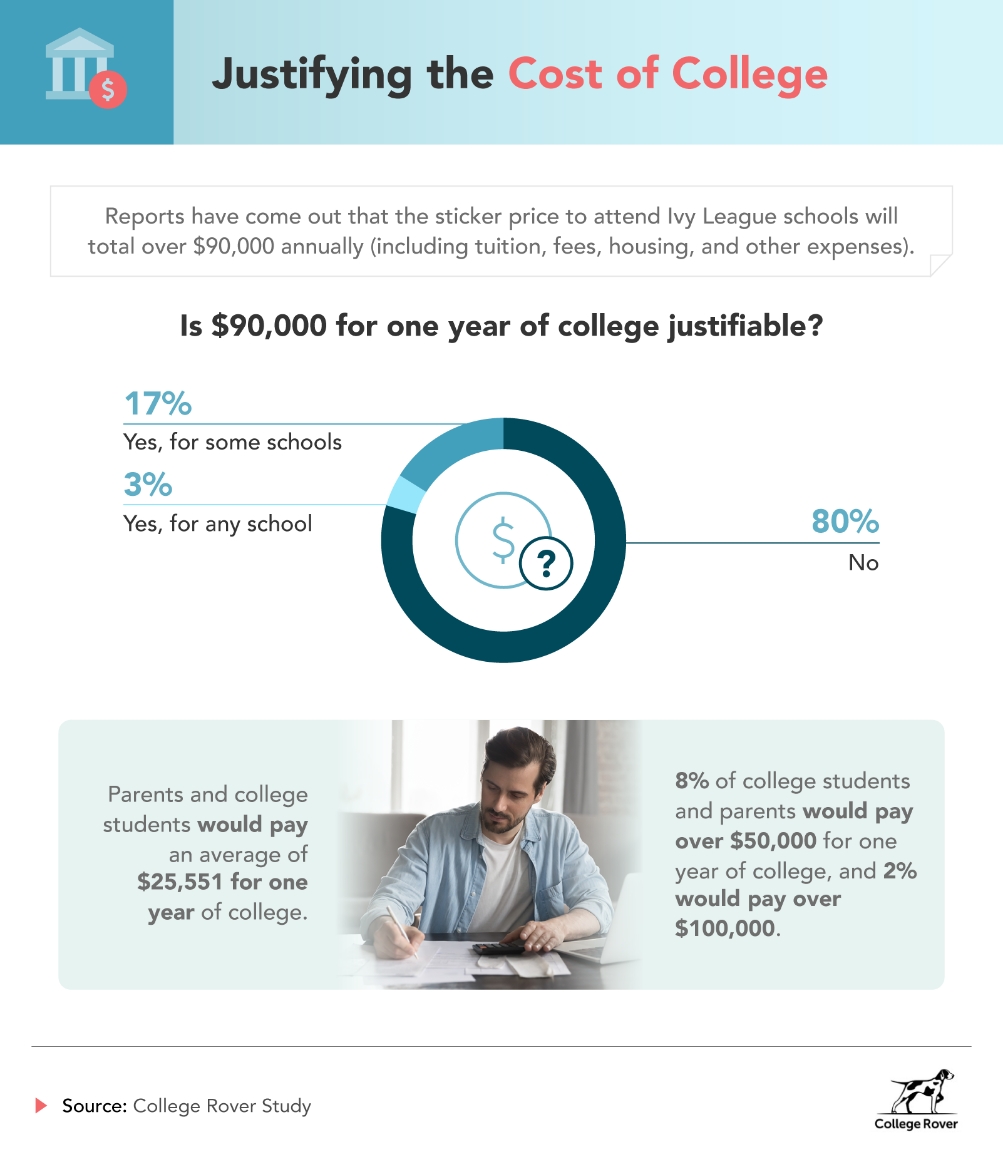

- 4 in 5 college students and parents (80%) believe $90,000 for one year of school is an unjustifiable expense.

- 8% of college students and parents are willing to spend over $50,000 for one year of college, and 2% would pay over $100,000.

The financial strain of FAFSA delays

- College students expecting more money from FAFSA this year compared to last year are looking for $16,025, on average.

- College students expecting over $10,000 from FAFSA this year are:

- 32% more likely than those expecting under $10,000 to consider student loans due to the FAFSA delay.

- 40% more likely than those expecting under $10,000 to enroll in a more affordable college if their financial aid doesn't come through on time.

College expenses

- Parents of college students are more likely to believe $90,000 for one year of college is unjustifiable (84%) compared to college students (79%).

- 32% of college students are only willing to spend a maximum of $10,000 or less for one year of college education.

- 3% of parents of college students are willing to spend over $100,000 for their child's college education.

Methodology

For this study, we surveyed 1,006 college students and parents of college students about how the FAFSA delay is impacting their personal or child's enrollment in school for 2024. Among the respondents, 74% were college students, and 26% were parents of college students.

About College Rover

College Rover offers a unique comparison tool that enables students and parents to easily compare colleges based on objective data points like tuition, admission standards, and graduation rates. Unlike traditional rankings sites, our tool focuses on providing comprehensive, unbiased information to help users make informed decisions.

Fair use statement

Feel free to share these findings for noncommercial purposes, but please provide a link back to this page so readers can view the full survey results and methodology.